When evaluating a bear market strategy, one of the questions that should be pondered is: How do major negative news stories impact the strategy? What happens during the proverbial Black Swan event? In the spirit of answering these questions, I’ve chosen four events that impacted the overall market and compared the results of the SPY (SP500 ETF) with our volatility based strategy, the MultiStage Trading System.

Event #1 - 9/11 Attack:

The events surrounding 9/11/2001 caused a sudden plunge and panic in the market. It was so dramatic that most exchanges halted trading for a day to allow things to settle a bit. In fairness to the SP500 numbers I tested a period from 9/10, right before the news, through 10/10/2001 in order to allow some recovery time. The results would be far more dramatic if I had on tested the few days around the event.

Event #2 - Financial Crisis of 2008:

The market formed a top in the Fall of 2007 and had been heading south for approximately a year prior to the peak of the financial crises (at least the peak of the media exposure). Major exposure to the crisis (such as the plight of Lehman Bros.) started hitting the news in early October and market dropped quickly. As before, in order to allow some time for the market to recover and settle I tested from 10/3 to 11/3/2008.

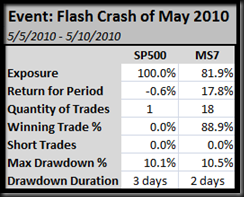

Event #3 - Flash Crash of May 2010:

A strange event occurred on May 6, 2010, which is still being investigated. The SP dropped 10% and almost immediately recovered. Whether due to a computer glitch, some master conspiracy to manipulate the markets, or some other odd factor, it was an event that shook the confidence of investors everywhere. To test this event I used the dates of 5/5 to 5/10/2010, a period where the SP500 was nearly flat.

Event #4 – 2011 Japan Earthquake:

On March 11, 2011 a devastating quake, measuring 8.9 on the Richter scale, struck Japan, causing enormous Tsunamis in the South Pacific. In the following days the aftershocks were felt in the world markets, sending the SP500 to a correction of more than 5% off it’s recent high. This one is a little tougher to test since it’s very recent, but I believe there has been sufficient time for the market to recover and settle. I’ve used dates from 3/9 (the day before the quake, US Time) to the current date.

There are, of course, many other events we could choose, and these were just a few off the top of my head. The main point is that volatility based systems seem to do quite well during the most turbulent times imaginable. If you have an interest in any specific event just let me know. I’m happy to test it.

Finally, let me reiterate as I have so many times, that these results are hypothetical. They are computerized back-tests, which may never be repeated. Also, I use no commissions or slippage in any of the cases.

Good Trading…

No comments:

Post a Comment