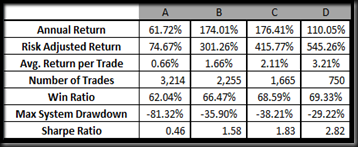

Okay, I promise… last post on optimization. We’ve determined in the last post that optimal settings were quite different than what we originally suggested. Taking a lesson from Part 8, I’ll set the system to buy at 2% below the 5-day moving average, and above the 150-day moving average. Let’s see how that looks in a back-test compared to our earlier development:

Column D represents this most recent test, with the other columns being our previous tests. As you can see, some parts are better, some not. This is why I mentioned in the last post that it was important to decide what success looks like to you before optimization. If you were interested only in CAGR, these are definitely not better parameters. But if you like Sharpe Ratio and Average Return per Trade, these are great settings.

And of course, here’s the equity curve. If you don’t remember the previous back-tests go back and take a look. This is a massive improvement. It’s relatively smooth line with no major dips.

Hopefully these last three posts have given you an idea of what optimization is all about. As you might imagine, you can spend a lot of time with many different parameters. We’ve barely scratched the surface.

Finally, please, please, PLEASE don’t trade this system. There are many issues… for starters 30% drawdowns. Not many can stomach that. Trading equities is dangerous! This has purely been an example, which I hope has been instructive. In the next post you’ll get a little taste of what else might go wrong when we test out-of-sample data.

Good Trading…

No comments:

Post a Comment