In the last post we defined two specific timeframes when big bear markets took place. I’ve back-tested my MultiStage Trading System for those times, so you can get a feel for how a system like this might perform in a down-trending market. As a refresher, the bear markets were:

- December 2000 to August 2003

- February 2008 to November 2009

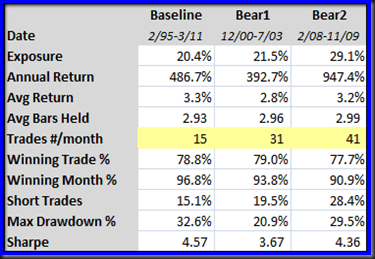

How did the MultiStage Trading System perform in these tests? First let me say the these are raw data tests. No slippage or commissions were taken into account. And try not to drool too much over the annual returns. In the real world I don’t get these returns for a multitude of reasons. They are directionally correct, however, and useful to me in real world trading. All that said, here is a look at the relevant numbers:

The first column is a baseline of results from all trades from 1995 through the current day. The interesting thing is that many of the key numbers are very similar, especially in the 2008 bear market. Win rate, winning months, gain per trade, bars held, and even the Sharpe ratio are almost identical to the baseline. The quantity of trades tells the story. In both bear markets we averaged more than twice as many trades as during the overall period.

Here is an important point about profiting during down markets! Bear markets represent extremely volatile periods in the stock market. Therefore, strategies that thrive during volatile periods will often do very well in bear markets. In the case of this particular system, it thrives because many more trades are triggered during volatility. More trades means more profit.

Are short trades a factor? To a small degree they are. As you can see we do a fair amount more short trades in the bear markets, but they still never get to be more than 28% of our total trades, so the bulk of our profit is still coming from long trades. Short trading is a possible approach during a bear market, but it requires one to target when the markets are shifting, and choose the right target stocks for shorting. Volatility trading does quite well when the market shifts take place, and doesn’t really care where it’s going.

Next time we’ll take a closer look at how the bull market periods compare to the bear market periods. Until then…

Good Trading…

Bill,

ReplyDeleteI really enjoy this blog. One of the best out there re: system trading and Amibroker. How can I contact you? I don't see an email. I'd like to answer your question you posted on my blog, then I have some for you. Hopefully we can connect soon. simplequant at gmail dot com.

Thanks,

Chris